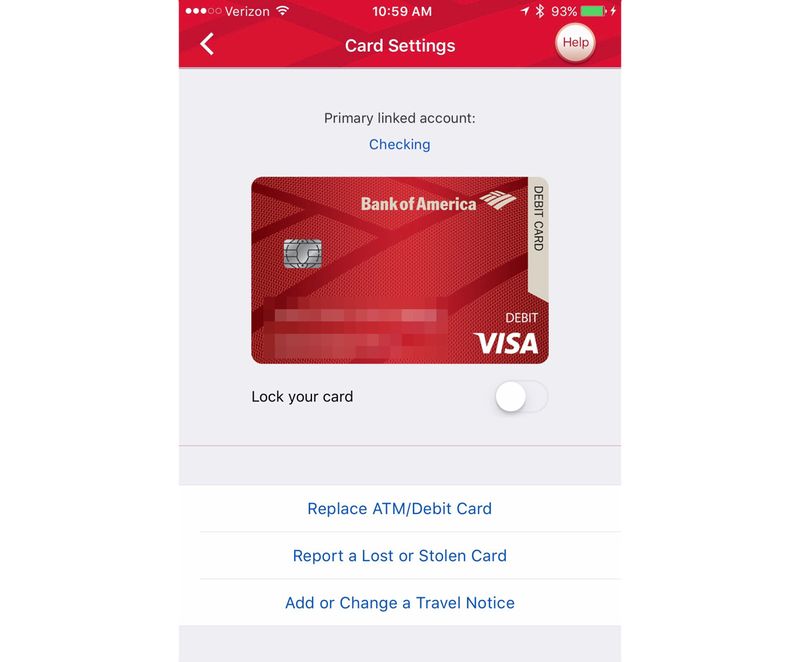

When did banking apps from the big finance giants suddenly get good? Lately I’m finding the various money-related apps on my phone (Bank of America, Citibank, Capital One) to be genuinely helpful and capable of things that they couldn’t do even a year ago. They’re even becoming intuitive. I can temporarily lock my debit card if I’ve misplaced it but am not yet convinced it’s lost. I can activate replacement cards with a tap — something that always required a call to an automated telephone line.

And then you’ve got the usual stuff: automated payments, transferring money, ordering checks, and snapping a photo of a check for instant deposit. That last trick was somethingcool that many banking apps could do in the days when they were not-so-useful in other places. Pretty much all of them now use Touch ID on iPhone; the adoption of fingerprint security on Android has seemed a little slower, but they’re getting there. Two-step verification is now commonplace as well. You can withdraw cash with your phone from some ATMs, even. That’s been possible elsewhere in the world for some time, but is a mind-blowing thing to behold for some of us in the US.

/cdn0.vox-cdn.com/uploads/chorus_asset/file/7625453/bofa.jpg)

Customer service, which has been a pain point of bigger banks for years, is also improving in that it’s getting faster and requires little from you. If any of the companies I’ve got an account with detect a fraudulent charge, it’s usually declined and I get a text message about it within seconds. Verifying that it was legitimate just requires a quick SMS reply. Try the purchase again, and it goes through. No waiting on hold with some 800 number.

These conveniences aren’t a reason to stop scrutinizing your monthly statement for irregularities, but the big money apps are now efficient enough at most things that once-alluring alternatives like Simple have lost their luster for me. The other day I got an email from Simple saying my account had been closed because I hadn’t given permission to make the transition to their new parent bank. My response was basically ¯\_(ツ)_/¯. Simple’s excellent customer service and the ease of messaging back and forth with an actual person weren’t enough to hook me.

Likewise, I think Square CEO Jack Dorsey might’ve sounded a little too dismissive the other night at Recode’s Code Commerce when discussing why his customers might want to store money with Square Cash and use it like a bank. “It’s crazy to think about, but people just want a more modern interface to their finances,” he said. “Something that’s simple and straightforward and modern really wins.”

/cdn0.vox-cdn.com/uploads/chorus_asset/file/7625423/iphone_silver.png)

But beyond that and Venmo — sorry Jack — for paying my rent and splitting brunch, I’m mostly okay with the big giant corporate apps. A few years or just months ago, that wasn’t the case. And if average app store ratings are a valid indication, a lot of people are starting to feel more satisfied. Bank of America: 4.5 stars. Citi Mobile: 4.5 stars. Capital One: 4.5 stars. Scandal-ridden Wells Fargo has a 2.5-star average on iOS, but 4.5 on Android. Even PayPal is faring well there, despite the feeling of sleaze I get when writing that name out.

And that’s a good reminder that no bank is your friend. They open accounts without consent. They’re forever happy to bury you in unfavorable interest fees or overdrafts and charge any other penalties where possible. And some of their recent efforts like smartwatch apps are laughably useless. The mobile wallet thing should really be left to Apple, Google, and Samsung.

I can do pretty much anything else inside Bank of America’s app without being overcome with frustration.* That’s progress, even if it took too long to get here. These are essential utilities that should work wonderfully and be easy to understand. And I’m sure there’s still a lot of mediocrity out there. Big banks? Still awfully shady. But at least their developers are making smarter decisions and pushing forward. Now if we can just make those chip card transactions a little faster…

*Stupid moves still happen, though! It appears that Bank of America’s latest iOS update prevents you from pasting in your account password. That’s the kind of idiotic thing that might discourage people from using secure, randomized passwords.

[Source:-The Verge]