This article is reprinted by permission from NextAvenue.org.

Not long ago, new personal finance apps and sites were all the rage. They’d help you size up your finances (Mint, FlexScore), manage your debt (CreditKarma, Credit Sesame) and invest smarter and for less money (Wealthfront, Betterment, Future Advisor, Blooom). But based on what I saw at the annual Finovate conference in New York City recently, I’d say: Game over.

Sure, there are still a few eager entrepreneurs conjuring up clever money-management tools for your smartphones, laptops and tablets. I’ll tell you about two shortly.

But the 10th annual FinovateFall program, presenting the latest in fintech to 1,500 attendees, was mostly about helping banks add electronic arrows to their quivers through online banking so they can attract and keep customers — especially millennials.

“In the early days of Finovate, we saw more presenters trying to disrupt the banking model and go around banks,” Greg Palmer, vice president of Finovate and host of FinovateFall 2016, told me. Back then, they were dreaming up personal financial management (PFM) tools. “Now, companies are realizing they need to go through banks. Also, I’ve noticed on the flip side, that banks are more willing to engage in technology. There’s a fear of being left behind — no bank wants to be the last one,” said Palmer.

Contents

Prime target: millennials

And why the millennial magnet?

“A lot of bankers are concerned about losing that generation,” said Palmer. “Millennials are in a bucket all their own at the moment for banks. That’s either fantastic or terrifying, depending on your point of view.”

The low-hanging fruit is ripe. Many millennials are worried about their financial future; according to a Wells Fargo WFC, -0.33% survey I wrote about, 64% think they won’t accumulate $1 million in savings over their lifetime. But millennials are also three times more likely than boomers to bank using mobile devices, the 2016 FIS Consumer Banking PACE Index noted. They’re also four times more likely to use mobile apps from their primary financial institution than another source.

Do you want to chatbot?

The top trend at this year’s Finovate (I’ve been attending since 2012): chatbots for bank customers, with pseudohumans texting, emailing and conversing, answering questions such as how much you’ve been spending, whether your paycheck was deposited and what to do with a bonus you received, as well as helping you transfer cash between accounts, pay bills or find a nearby branch.

Finovate featured Clinc’s BankCoach (“a supersmart Siri for your finances,” said Clinc’s Andrew Bank), Envestnet’s Yodlee (“dynamic intelligence to make better financial decisions”) and Kore’s Banking Bot, among others. Kore’s executive vice president for sales, David Schreffler, told the audience: “It’s not whether to have a bot, but how soon can you have one in the market?”

Perhaps the better question is: Are chatbots ready for customers?

A recent Forrester Research report warned that most banks should hold off offering chatbots for two to three years, until the artificial intelligence technology has improved. Said Forrester analyst Peter Wannemacher: “While someone may not fret much when ordering a taco is clunky or doesn’t work, the stakes are too high when it comes to actions and advice related to people’s money.”

Two new offerings worth considering

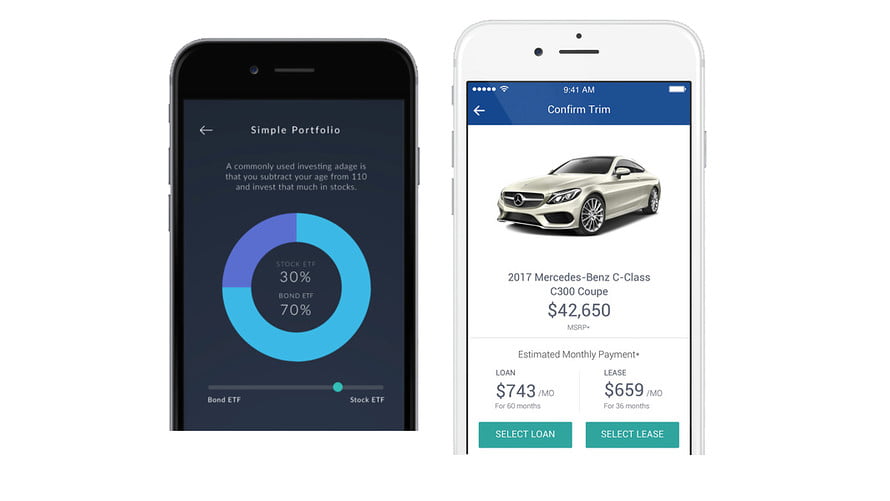

Chatbots aside, I was intrigued by two offerings for Next Avenue’s 50-plus audience: the Autogravity car-financing service and the M1 Finance robo-adviser.

Autogravity, one of the six presenters voted best of show by the audience, aims to disrupt the new-car-financing process. The premise: Know your payment options before walking into the dealership. Serge Vartanov, Autogravity’s chief marketing officer, said the current system “is suffering from a customer experience gap and a technology gap. It’s where travel was 10 years ago and the taxi industry was five years ago.”

Currently, Autogravity offers a useful research tool that lets you compare new-car payments on particular models by downloading the app on iOS or Android or by going to the Autogravity site. If you live in California, you can also use Autogravity to zip through a financing application and get approved; that feature is due to expand to the 10 largest states by the end of this year and nationwide next year.

You’re not necessarily guaranteed the best financing terms that you might find by shopping around on your own, though. Autogravity’s finance deals are with its affiliate lenders, which include car makers and big banks. “We give you a set of options compared to the current experience where you need to spend hours researching,” Vartanov told me.

M1 Finance bills itself as an online robo-adviser “for long-term investors.” Translation: You buy stocks and stock or bond ETFs (no mutual funds) through M1 and note your investment allocation preferences — percentages to keep in different stock and bond sectors. M1 will then automatically rebalance your portfolio as necessary.

For example, when you want to sell a certain dollar amount, M1 will look to see which parts of your portfolio represent a higher percentage than you initially wanted and will first sell from there. Similarly, when your stock dividends arrive, M1 deposits them in portions of your portfolio that are underweighted.

“It’s automation, but with customization,” said Brian Barnes, CEO and founder of M1 Finance. “It’s as easy to manage as a savings account.” And if you’d like to select one of M1’s template portfolios (savings, general investing, retirement), you can do that, too.

The long-term part? “Traditional wirehouse firms are trading platforms and charge by commission, so they push customers to make a ton of trades and you’re charged 10 bucks every time,” said Barnes. M1 charges a flat 0.35% a year and takes its cut quarterly.

In the future, he said, M1 hopes to add checking services and bill-paying features. But no chatbot for now.

Richard Eisenberg is the senior web editor of the Money & Security and Work & Purpose channels of Next Avenue and managing editor for the site. He is the author of “How to Avoid a Mid-Life Financial Crisis” and has been a personal finance editor at Money, Yahoo, Good Housekeeping and CBS Moneywatch. Follow him on Twitter @richeis315.

This article is reprinted by permission from NextAvenue.org, © 2016 Twin Cities Public Television, Inc. All rights reserved.

[Source:-Market Watch]