JAKARTA, Indonesia— BlackBerry Ltd.’s decision to license software and outsource handset production globally represents a win for the Canadian company’s biggest market, Indonesia, which is seeking a larger share of the smartphone value chain.

BlackBerry’s new venture signed last month with an affiliate of PT Telekomunikasi Indonesia Tbk, the country’s largest wireless carrier, will see its Indonesian partner produce, promote and distribute all Blackberry-brand devices in Indonesia.

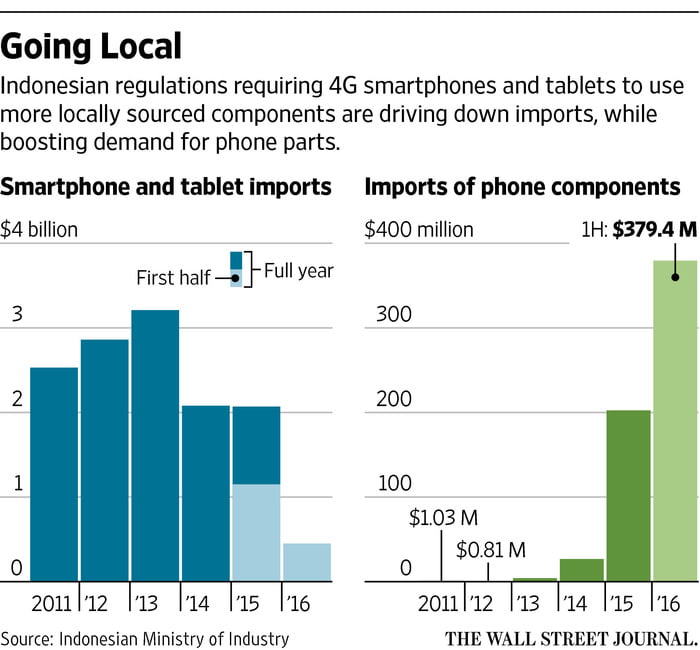

The venture comes as international phone vendors gear up to comply with the latest “Made in Indonesia” regulations to tap growth in what is poised to become the world’s fourth-largest smartphone market by 2020, with total annual sales of nearly $1 billion by then, according to research firm Euromonitor International.

Adopted in July, the latest rules give producers more options when it comes to meeting next year’s 30% quota for “local content”—which previously focused on local manufacturing but can now include software or investment—in their 4G-enabled tablets and smartphones sold in Indonesia, up from 20% this year. The requirement will rise to 40% in 2018.

BlackBerry’s joint venture was “created in support of the Indonesian government’s effort to promote manufacturing of locally sourced products,” said Ralph Pini, chief operating officer and general manager of devices at the Waterloo, Ontario-based firm, which said last month it would stop making phones, and instead focus on software. Mr. Pini declined to disclose details of the investment.

Indonesia is a crucial market for BlackBerry. Its BBM messaging service is the top messaging platform in the country of 250 million people with nearly 60 million monthly active users as of June, BlackBerry said. WhatsApp and Facebook Messenger trail behind with about 50 million active users for each app, according to estimates from U.K.-based social media consultancy We Are Social.

ENLARGE

ENLARGEIn 2012, Indonesia’s government introduced regulations requiring importers of mobile phones to set up assembly plants in the country by the end of 2015. In 2013, it imposed a 20% luxury tax on imported cellphones to rein in its current-account deficit. In September 2014, the government issued regulations requiring all 4G devices sold in Indonesia to include at least 30% locally-sourced components by 2017.

Foreign technology companies initially expressed reluctance to answer the call of Indonesian authorities, arguing that Indonesia doesn’t have a reliable supply chain to support the manufacturing of consumer electronics.

“Most of the manufacturing plants [in Indonesia] are restricted to assembling due to the lack of a component ecosystem in the country,” said Tarun Pathak, a senior analyst at Hong Kong-based research firm Counterpoint.

Vendors with minor market share in Indonesia, such as Apple Inc. and Xiaomi Corp., are likely to rely on software development rather than manufacturing to meet the local content threshold, analysts said. Xiaomi disabled the 4G network on its Redmi Note 3 Pro phones to get around the earlier legislation. Apple’s 4G iPhone 6S, 6S plus, and SE aren’t officially sold in the country, but they can be found on the black market.

Analysts say the more-flexible regulations passed in July make it easier for handset makers to meet requirements, given that they allow the quota to be reached via other options in addition to manufacturing.

ENLARGE

ENLARGE“Vendors like Apple and Xiaomi, who have a strong software side to their mobile business, get the much needed flexibility,” under the latest rules, said Rajeev Nair, analyst with research firm Strategy Analytics. “The challenge though for them would be in finding a sizable base of software professionals and developers as they scale up.”

Indonesian government officials said after a visit by top officials from the nation to Silicon Valley last year that Apple plans to open an R&D center in Indonesia next year. Apple declined a request for comment.

Xiaomi hasn’t disclosed its R&D plans, saying only that “Indonesia is a strategic market for Xiaomi and we are committed to grow” in the country.

Some firms, including Lenovo Group Ltd., Oppo Electronics Corp., and Samsung Electronics Co., set up local facilities in 2015 while others tapped existing local manufacturers to assemble their phones.

Samsung is the leader in the Indonesian smartphone market, with market share of about 26% in the second quarter of this year, according to research firm International Data Corp.

The new rules have also created software-development opportunities, say analysts, including games and apps installed on smartphones, in addition to assembling or manufacturing devices. Companies are now required to pre-install on their phones seven locally made mobile apps or 14 games with at least a million active users.

One local game developer poised to benefit is Bandung-based Own Games, maker of “Tahu Bulat” or “Round Tofu,” which boasts two million monthly active users. Co-founder Eldwin Viriya said that phone vendors have approached him to have the game preinstalled. He declined to name the companies.

“I fully support the software scheme because we can really compete,” says Andreas Diantoro, CEO of Microsoft Indonesia. “This is the area where we have a lot of strength. When you’re looking at hardware components…it takes economy of scale to actually do that, I’m not sure that Indonesia has that scale.”

[Source:-The Wall street Journal]