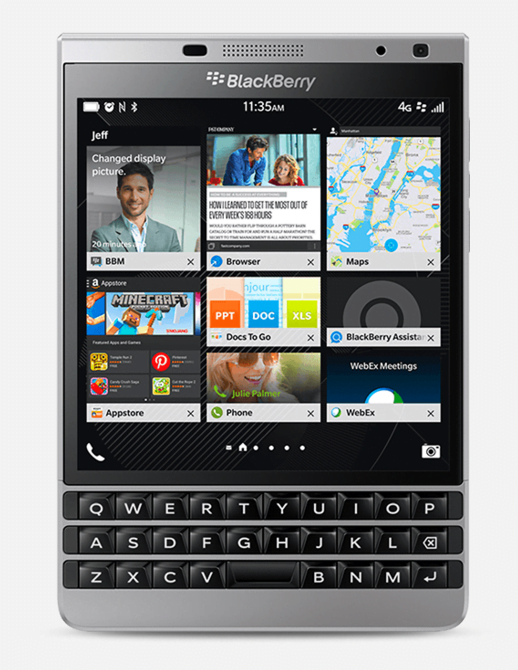

BlackBerry is understood for its handsets, consisting of the PassPort. but its destiny is in all likelihoodto rely on its software program. source: BlackBerry.

BlackBerry ‘s enterprise is shrinking. The organisation‘s revenue declined just over 35% closing yr on an annual basis, as it shipped increasingly more fewer handsets. but now not each portion of BlackBerry’scommercial enterprise is in decline: The Canadian mobile company is seeing growing demand for itssoftware and services. last yr, sales from BlackBerry’s software and services rose 99% on an annualfoundation, hiking to $494 million from $248 million in its 2015 financial yr. On an adjusted foundation, itmore than doubled, rising to $527 million.

BlackBerry’s destiny seems increasingly more tied to its software. For buyers, the state of BlackBerry’ssoftware commercial enterprise is emerging as the most important element riding the employer‘seffects.

enterprise cell management and security

BlackBerry’s software and services enterprise facilities mostly around organisation mobility control(EMM), where the business enterprise is the market chief with 19% marketplace proportion. BlackBerry’s BES12 gives IT departments the tools they need to manipulate and control the cellular gadgets of theiremployees, often smartphones. BlackBerry has its personal proprietary cell operating machine, BB10, butits EMM answers paintings across all structures, such as iPhones and Android devices. BlackBerry has used acquisitions in recent quarters, such as AtHoc and WatchDox, to strengthen its EMM services, and now gives organisations relaxed messaging and record management. final 12 months, it obtaineddesirable generation to convey extra security improvements to its EMM solutions.

BlackBerry additionally consists of sales from its QNX enterprise in its software and services. QNX is BlackBerry’s embedded running machine. it is often found in automotive infotainment structures, in which it powers approximately 50% of the automobiles on dealer masses. BlackBerry hopes to amplifyQNX’s presence through the years, leveraging the boom of related gadgets widely referred to as theinternet-of-matters.

BlackBerry additionally consists of sales from IP licensing in its software program and offeringsbusiness, and has these days entered the cyber safety consulting marketplace. BlackBerry’s IP did notgenerate any sales for the business enterprise within the fourth quarter, and its protection consultingeffort stays in its infancy. nevertheless, control believes both may want to boost up over time and forceextra sales.

a larger a part of BlackBerry

growing call for for its software program have to benefit BlackBerry’s shareholders. ultimate quarter, BlackBerry’s gross margin came in at 48.7%, up from forty four.9% on a sequential foundation. BlackBerry’scontrol attributed the improvement to its growing software enterprise.

In general, BlackBerry believes that its software and services sales will grow 30% in its monetary yr 2017 (which started in March). That may not be as spectacular as its 106% surge ultimate yr, but it would make it a greater significant portion of the bigger BlackBerry commercial enterprise. software and offeringsgenerated just underneath 23% of BlackBerry’s revenue ultimate yr. Analysts estimate that BlackBerry will generate $2.sixty seven billion in sales this 12 months. If they’re proper, and BlackBerry’s guidanceproves correct, software program will account for about 26% of BlackBerry’s 2017 financial year sales.

overlook approximately phones

which means that the bulk of BlackBerry’s revenue will nonetheless come from its handsets and serviceget admission to fees, because it did in fiscal 12 months 2016. however in some unspecified time in the future in the future, it is probable that the overpowering majority of BlackBerry’s sales will come from its software program and offerings.

sales from BlackBerry’s provider get entry to expenses has been declining for years, and BlackBerry expects it to hold (it is modeling a 18% drop this quarter). these are the fees BlackBerry prices companies tomanage records for its older BB7 handsets, that are increasingly more falling out of style. on theidentical time, it is new phones aren’t finding tons inside the way of fulfillment. BlackBerry recognizedrevenue on simply 3.2 million smartphones remaining 12 months, down from 7 million within the yr prior.

CEO John Chen has admitted that the corporation might be pressured to go out the handset commercial enterprise inside the future if it can’t make the department profitable. BlackBerry has been loathe to try this, because it believes its logo is intrinsically related to its records as a maker of comfy smartphones.despite the fact that companies aren’t the usage of its gadgets, they may consider the BlackBerry namedue to the fact they apprehend its reputation, and as a result be willing to purchase BES12 or otherEMM solutions for their handsets. in an effort to stimulate call for, BlackBerry will release less expensivetelephones going forward , but competition inside the phone marketplace is brutal.

maximum likely, at some future date, BlackBerry will prevent making handsets and its carrier get entry toprices will dwindle away to almost not anything. whilst that occurs, the business enterprise will become a company of mobile software. It remains to be visible if growing software demand can offset the decline of its different organizations, but it’s the one component of BlackBerry investors need to fliptheir interest to.

A mystery billion-greenback inventory opportunity

the sector‘s largest tech corporation forgot to show you something, however some Wall road analysts and the fool didn’t omit a beat: there’s a small enterprise it’s powering their emblem-new gadgets and the approaching revolution in era. And we suppose its inventory charge has nearly unlimited room to run for early in-the-understand investors! To be certainly one of them, simply click on right here .

the article This BlackBerry Ltd. commercial enterprise greater Than Doubled closing 12 months at the start appeared on idiot.com.

Sam Mattera has no role in any shares mentioned. The Motley fool has no role in any of the stocksmentioned. attempt any of our silly newsletter services loose for 30 days . We Fools won’t all keep theequal critiques, but all of us agree with that considering a various variety of insights makes us higherinvestors. The Motley fool has a disclosure coverage .

Copyright © 1995 – 2016 The Motley fool, LLC. All rights reserved. The Motley idiot has a disclosure policy .

The perspectives and opinions expressed herein are the views and critiques of the writer and do notalways reflect those of Nasdaq, Inc.