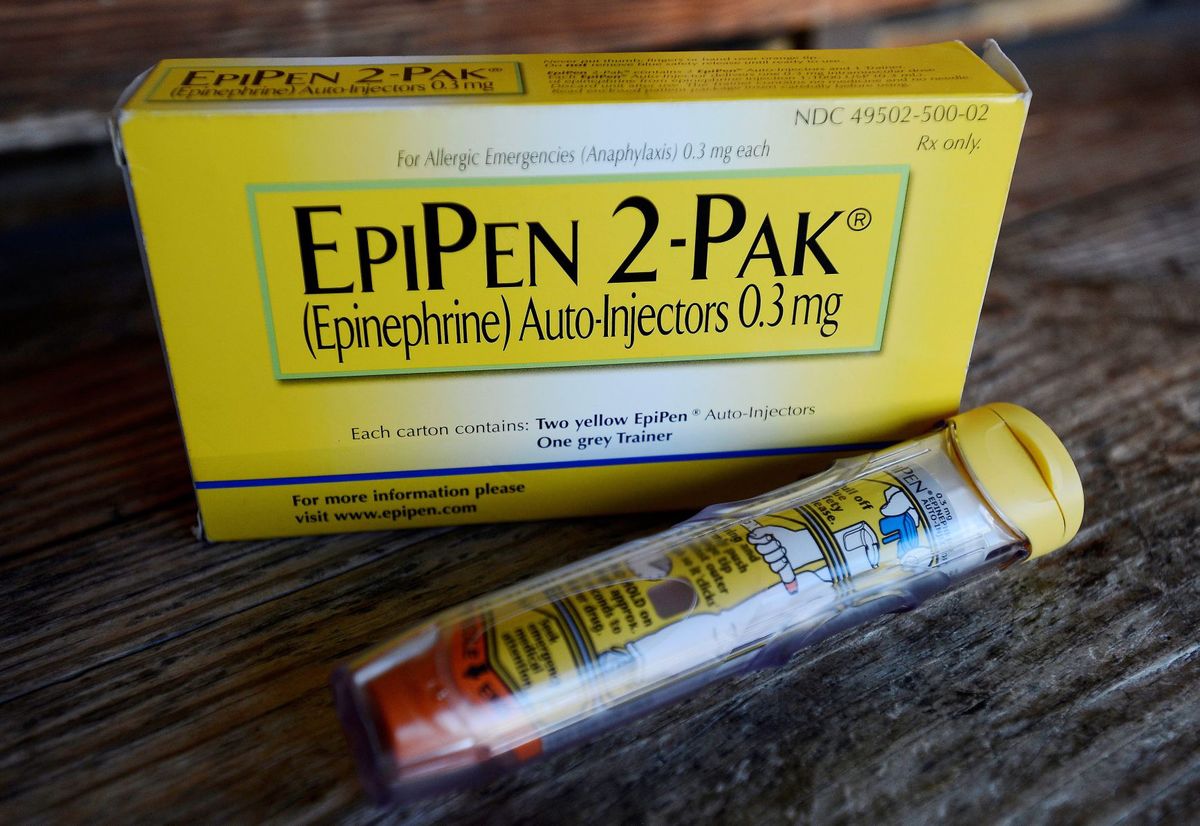

WASHINGTON (AP) — Facing public furor for the price of its emergency allergy shot EpiPen, Mylan Pharmaceuticals quickly pointed to a familiar industry solution: copay discount cards.

Copay coupons or cards have become a ubiquitous part of the pharmaceutical business, offered through websites, mobile apps and doctor’s offices. Patient advocates say they can bring down out-of-pocket expenses for patients who face high copays and deductibles. Mylan last month boosted its discount cards to cover $300 of insured patients’ copay costs, up from $100.

But they also have a clear business purpose: steering people toward brand-name drugs when cheaper options are often available. Researchers say those higher costs drive up expenses for insurers, employers and the health system at large.

Here is are some of the pros and cons of copay discount cards:

Pro: Lower out-of-pocket costs

As more employers move to cost-sharing health plans, their workers face higher expenses when filling prescriptions at the pharmacy. The average amount owed by a patient picking up a brand-name drug is $44, according to IMS Health, a health information company. Copay coupons offer reimbursement up to a certain level, such as $100.

Erin Singleton of the Patient Advocate Foundation said she directs patients to websites such asneedymeds.org and pparx.org, which compile coupon offers. Unlike some other patient assistance programs that offer free medicines or deep discounts, the coupons are not tied to income.

“It is something that should be considered regardless of your income,” Singleton said.

Con: Higher-priced drugs

Though consumers pay less at the pharmacy, research suggests they are passing on higher costs to their insurance companies, because manufacturers tend to offer the coupons on brand-name drugs that are competing against lower-priced drugs — often generics that sell for $4 or less at some retailers.

When a generic is available, pharmacists often automatically switch patients to the cheaper option. But when a patient uses a coupon, it short-circuits that process. The copay is lower, but the insurer ends up paying for the higher-priced drug.

“So those costs are going to come out in higher premiums,” said Wells Wilkinson, an attorney with Community Catalyst, a health care advocate group.

Pro: Prescriptions filled

An estimated 1 in 5 prescriptions in the U.S. goes unfilled, in part due to financial hardship. Some research suggests patients with copay discounts are more likely to fill — and stay on — their medications than those without them.

One 2014 study of patients taking high-priced specialty drugs for multiple sclerosis and other inflammatory diseases found that nearly half used copay coupons.

Con: Short-term solution

Coupon cards can improve access to drugs, but usually for a limited time. Across all brand-name prescriptions filled in the U.S., copay coupons are used only about 8 percent of the time, according to research published last year by IMS Health. Limiting their use: Many mail-order pharmacy programs do not accept the cards.

Additionally, the cards cannot be used at all by patients in federal health plans such as Medicare, Medicaid or Veterans Affairs. The cards run afoul of federal anti-kickback laws that prohibit companies from giving enrollees anything of value to purchase items paid for by the government.

[Source:-Omaha world news]