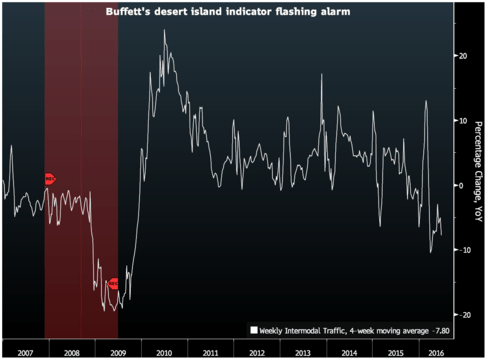

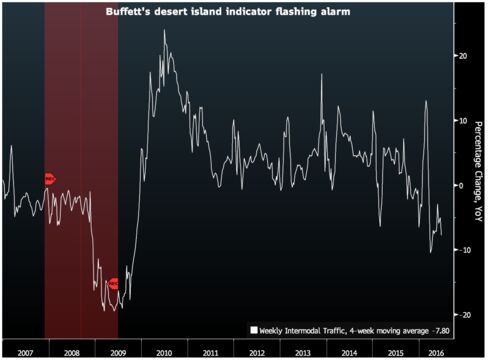

It’s frequently stated that Berkshire Hathaway Inc. Chairman and Chief Govt Officer Warren Buffett’sunmarried Preferred degree of financial pastime is railway site visitors.

Economists at Bank of The us Corp. Have additionally located the predictive strength of Buffett’s ‘desolate tract island indicator’ is especially robust relative to other weekly measures of actual pastime.

That makes the recent displaying for rail traffic, whose four-week transferring average is down 7.eightpercent yearly, particularly troubling:The not unusual citation of Buffett’s Favorite indicator, but, is a chunk incomplete. A complete quote from a 2009 interview includes each freight vehicle loadings and truck tonnage moved as what the Oracle of Omaha might awareness on if he had been abandoned on a desertisland for a month.

For a few motive — perhaps due to the fact Berkshire’s railway commercial enterprise dwarfs its trucking holdings — the second half of Buffett’s assertion is usually neglected.

And a latest record from Bespoke Investment Group underscores why It is essential to broaden the definition of the Oracle’s Favourite indicator to a couple of measures of freight hobby that allows you toget a more Correct studying at the state of the U.S. Financial system.

Bespoke discovered that there has been the tendency for trucking to be substituted inside the occasion of a huge downwards move in oil fees, and vice versa. In different words, trucking receives quite less priceywhilst gasoline charges decline because these automobiles use extra fuel to haul freight a given distance than trains do.”We are able to say quite optimistically that relative shifts between intermodal rail and truck tonnage are in massive part pushed through adjustments in oil costs,” wrote the analysts. “Goingforward, we anticipate the shift towards trucking from intermodal rail to retain.”

Truck traffic, their team notes, is up 5.5 percentage 12 months-over-yr as of May also, giving the influenceof a solid expansion within the U.S.

“Maintain this in mind while using either index as a stand-by myself measure of economic activity!”finish the analysts. “Neither is portray a clear picture.”